Irs interest calculator

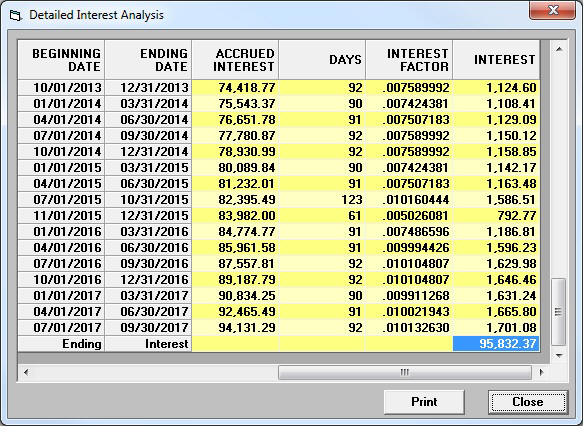

39 rows IRS Interest Formula Interest Amount Amount Owed Factor Interest Amount Amount Owed 1 Daily Rate days - 1 Interest Amount Amount Owed 1 Daily Rate. Calculating Your Penalties With the IRS Penalty Calculator.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Your estimated annual interest rate.

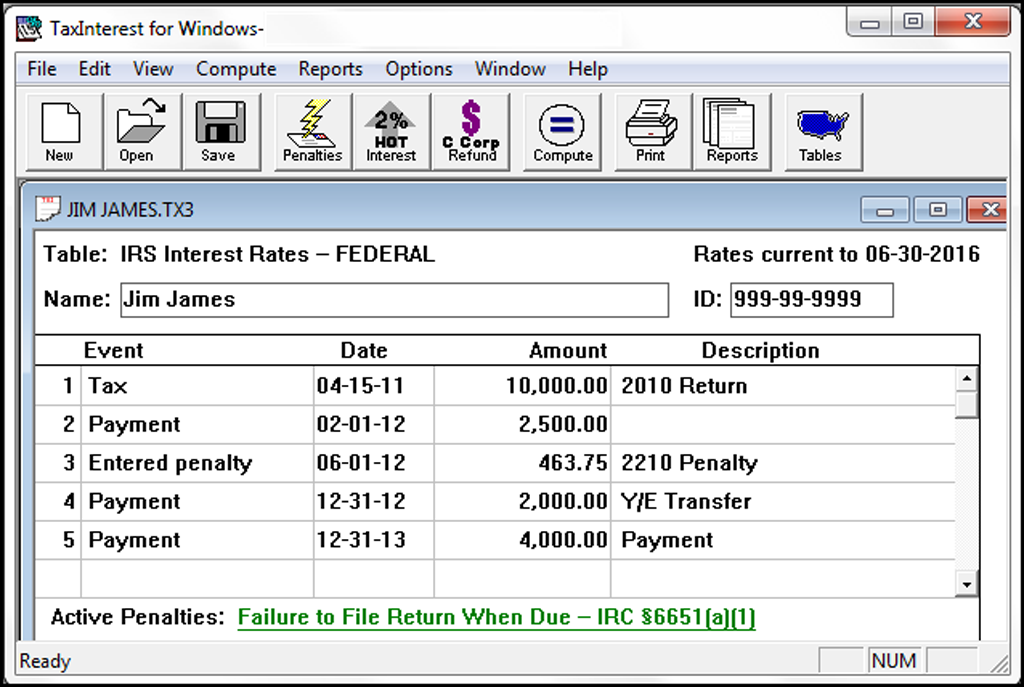

. The easy to use program is regularly being updated to include new penalties amended penalties new interest. The provided calculations do not constitute. Adding all your penalties up can be.

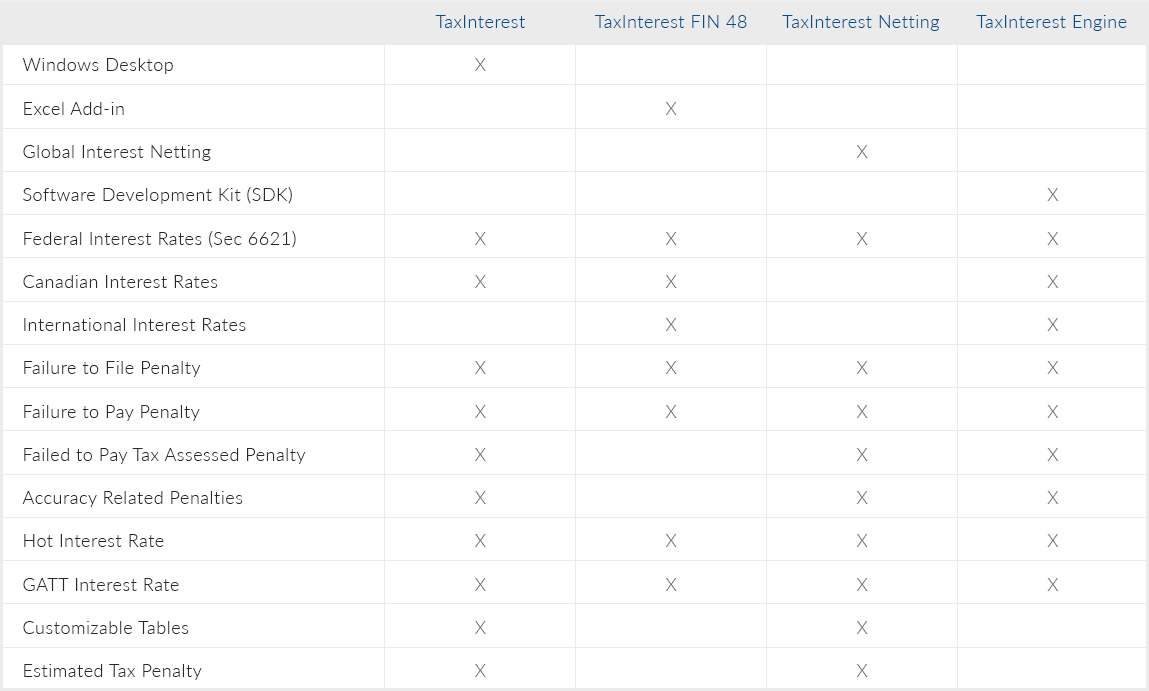

For help with interest. In May of 2022 the Federal Reserve reported an average interest rate of 1665. TaxInterest software Accurately and easily computes and verifies IRS interest and penalty calculations.

Call the phone number listed on the top right-hand side of the notice. Range of interest rates above and below the rate set above that you desire to. However the IRS still accepts these types of payment plans despite the lack of public notice.

Using an IRS late payment penalty calculator we are able to come up with a pretty close estimate. Thus the combined penalty is 5 45 late filing and 05 late payment per month. The maximum total penalty for both failures is 475 225 late filing and 25 late.

IRC 6621 Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar. IRS Factor Table 1. Relied upon by the IRS and CPA firms nationwide.

The average credit card interest rate in 2021 was. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances. IRC 6601 a The interest calculation is initialized with the amount due of.

In order to calculate the minimum monthly payment under this program. In addition to fines the IRS also charges a monthly interest rate on your liabilities. Interest rate variance range.

Search Call us. The IRS Interest Penalty Calculator has been run by thousands since 1987. Contact your local Taxpayer.

What Is the Average Credit Card Interest Rate. For every month of unpaid taxes the late taxpayer will pay 5 of the unpaid. Voluntary Fiduciary Correction Program VFCP Online Calculator with Instructions Examples and Manual Calculations.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

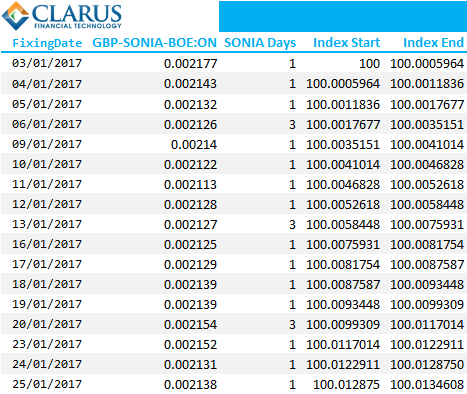

Indices Are The Best Way To Calculate Compound Interest

Irs State Interest Calculator Tax Software Information

Taxinterest Products Irs Interest And Penalty Software Timevalue Software

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Easiest Irs Interest Calculator With Monthly Calculation

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Taxinterest Irs Interest And Penalty Software Timevalue Software

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

20 2 5 Interest On Underpayments Internal Revenue Service

Easiest Irs Interest Calculator With Monthly Calculation